Wellcare | 2025 Medicare Advantage Commission Rates

As you prepare for the 2025 Annual Enrollment Period (AEP), we want to confirm our commitment to pay commissions for new and existing Medicare Advantage plans.

Wellcare will continue to pay the agent maximum fair market value commission rates for Plan Year 2025 (PY2025) enrollments on all Medicare Advantage health plans: Wellcare, Allwell, Fidelis Care and Health Net.

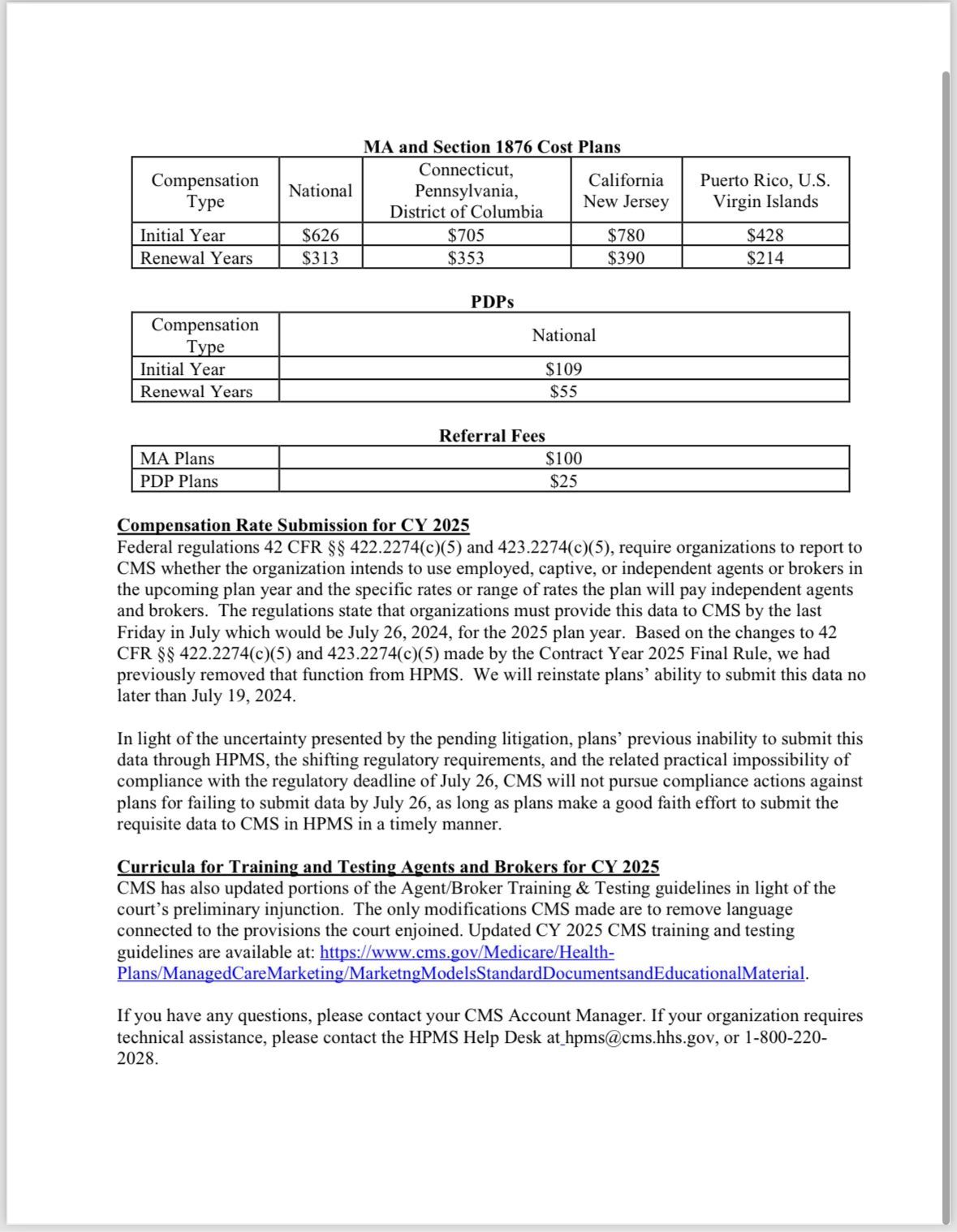

Medicare Advantage Agent Rates Effective Jan. 1 – Dec. 31, 2025

The contracting period for 2025 will begin on Sept. 3 in Centene Workbench. Please be sure to log in into the system to complete training now, and contracting when it becomes available.

Additional details on 2025 agency compensation will be shared soon.