Nationwide Annuity – Exclusive Distribution

Pinnacle is one of the select few FMO’s offering new Peak 10 Nationwide Annuity. This fixed indexed annuity from an A+ carrier provides clients with safety, growth, and lifetime income. Click here for Nationwide’s dedicated Peak 10 page: Nationwide Peak 10 Toolkit

Peak 10 Highlights

- Uncapped Indexing strategies with JP Morgan, AllianceBernstein, and S&P

- 2 Income Rider options:

- 4% roll-up (built-in)

- 10% bonus and 7% roll-up (1% fee)

- Optional Spousal Death Benefit Enhancement

- Concierge Care Service

Interested in Contracting?

Fixed Indexed Annuities in Retirement

Fixed annuities can present a great solution for many in retirement today. These are FIXED annuities so not subject to market risk. Clients can earn interest by keeping pace with inflation. Many Indexed Annuities, such as Nationwide Peak 10, provide guaranteed lifetime income as well.

Annuity Quoting Tool

Every Pinnacle Agent gets access to AnnuityRatewatch for free

Annuity Whitepaper

Contact us for complementary Annuity Whitepaper and Fact-Finding Tools.

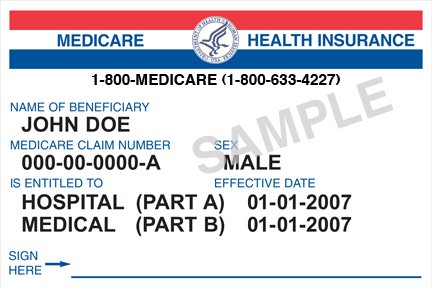

Life, Annuity, & LTC Pre-Set Appointment Program

We provide agents with pre-set appointments with State and Federal employees at a very low cost. This program sets exclusive appointments with pension-eligible employees. No commitment or up-front cost. Can be on appointment and selling very quickly. Pre-Set Appointment Best Practices

Are you new to Life, Annuity Sales?

If you are just getting started with Life, Annuity, and/or LTC products or are just learning about them, Click here for more info. Training is provided on products, fact-finding, selling concepts, etc.

1 (800) 772-6881 x7731 | sales@pfsinsurance.com

Author Position

Contact a Pinnacle Representative if you have any questions.

1 (800) 772-6881

support@pfsinsurance.com