Medicare Supplement Commissions

What is a Medicare Supplement?

A Medicare supplement is an addition to the Original Medicare that fills in some of the gaps, also known as Medigap. A Medicare Supplement policy can help pay for some of the remaining health care costs. Some examples of this would include co-pays, co-insurance, and deductibles. Medicare supplements are sold by private companies.

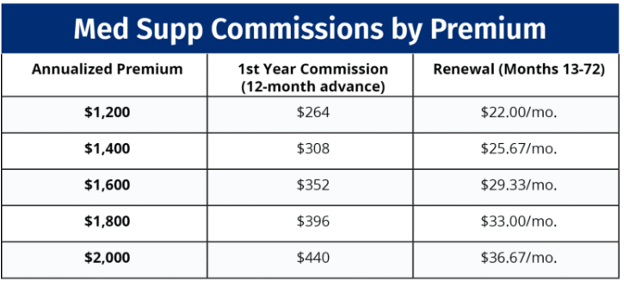

Medicare Supplement Commissions:

The average Medicare Supplement commission rate is approximately 22% with a 9 to 12-month advance. The average yearly premium for Medicare Supplement plans is about $1,600 depending on factors such as the client’s agent, smoker/nonsmoker, and what plan option is being selected. Typically, agents can earn renewal commissions for about six years.

Example using 22% commission and 12-month advance:

Even though the average commission on a Medicare Supplement is an average of 20-22% some commissions will vary. They can vary by state, plan, and carrier. You can always check with a sales director here at Pinnacle to see what the commissions are for a particular carrier.

Where does Pinnacle Financial Services come in?

Pinnacle Financial Services is a full service “FMO” that offers you some of the best technology in the business, like our proprietary Connect4Medicare platform, top-notch support service, and personal sales and marketing from the very start. There is no sales quotas or commitments that you need to make to us as we just want to help you grow your business. This is a win-win opportunity for all of us, so what are you waiting for? Join us at the top!

1 (800) 772-6881 x7731 | sales@pfsinsurance.com

Sales Director

Contact a Pinnacle Representative if you have any questions.

1 (800) 772-6881

support@pfsinsurance.com