Finding the Best Medicare FMO

Finding the Best Medicare FMO

The Medicare market has grown by leaps and bounds over the past several years. Independent insurance agents have plenty of options when searching for the Best Medicare FMO to help them grow their Medicare business.

In the sea of Medicare agencies agents will have plenty of options with promises such as, “The Best Medicare FMO”, or “Best IMO” you can find, when doing their due diligence.

But what does it take to truly be considered “The Best FMO”?

Here at Pinnacle Financial Services, we strive everyday to be just that, the best, for our agent partners. And for us service is job one.

In our company’s long history of working in the Medicare market we know that as an independent agent having a support structure in place is crucial to growing their business.

And we are not done there.

We provide an no charge all the tools and technology you will ever need.

- Medicare Quoting

- Quoting App for Phone or Tablet

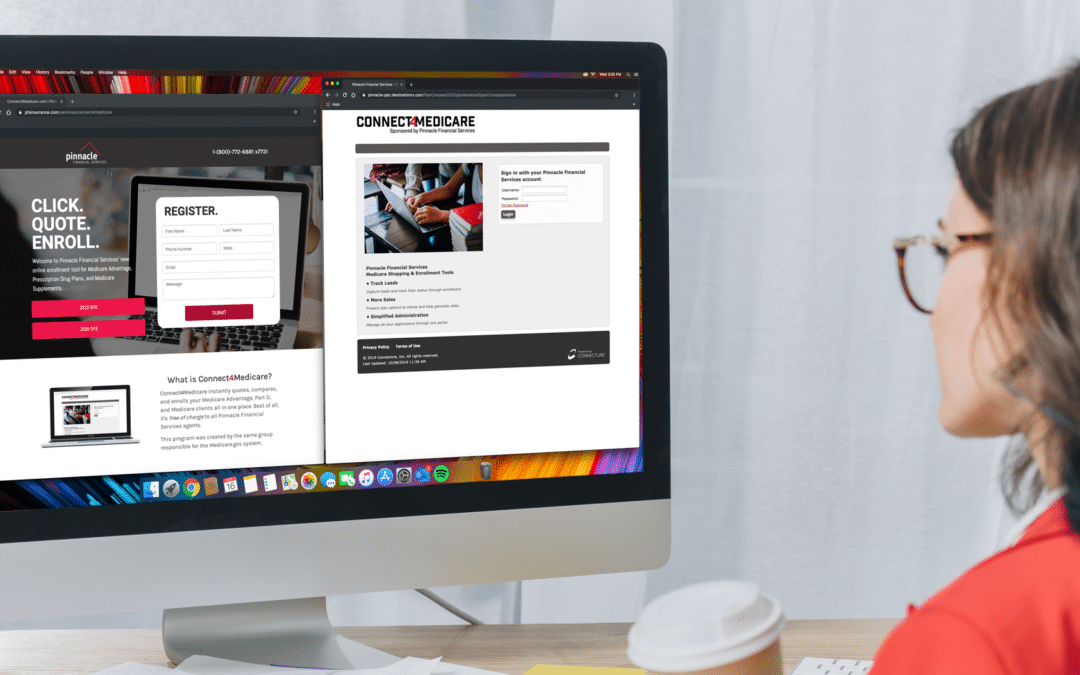

- Access to Connect4Medicare (the top Medicare quoting, comparison, and enrollment tool)

- Online Contracting

- Free Lead Program Option

- Top Medicare Commissions

- Ongoing Training (both in-person and remote)

- Free CE Credit Option

- CRM System

So whether you are new to selling Medicare plans or have a long history we want to help you grow your business. Our experienced support staff is ready to answer all your questions.

Call us today to find out more about how Pinnacle Financial Services can be the best Medicare FMO for you.

Questions or Concerns?

Reach out to a Pinnacle Representative today.