Humana | Assisting Members impacted by loss of Medicaid Status

Medicaid Redetermination:

Assisting Members impacted by the loss of Medicaid Status

What you should know

- Annual Medicaid redetermination was paused during the Public Health Emergency (PHE)

- February 1, states can begin their Medicaid Redetermination Process, with the potential for Medicaid disenrollment to start April 1, 2023

- Each state determines when its redetermination process will begin

- Impacted beneficiaries will be notified by the state approximately 60 calendar days prior to their disenrollment effective date from State Medicaid

What this means for you

- You can prepare for Dual Eligible Members to complete the redetermination process for continued Medicaid Coverage

- Dual Eligible Special Needs Plan (DSNP) members, who are found to be ineligible for Medicaid coverage, will need Agent assistance to obtain new coverage and maintain continuity of care

- Non-DSNP members, whose eligibility level changes, may also require a plan review to ensure they’re still on the plan best suited for them

Please remind impacted DSNP members of the following:

- Confirm contact information is up to date with the state

- Watch for a mail from the state requesting additional documentation

- Respond to any request from the state promptly and within the deadlines

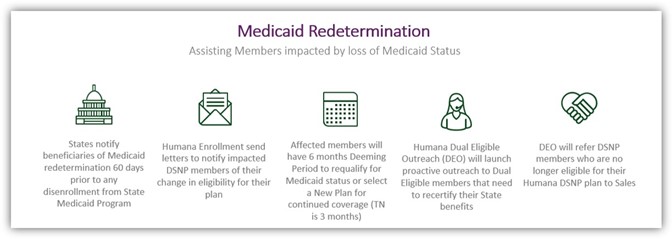

Process at a glance

Where to learn more

- Visit Ignite for a dedicated resource document to help assist agents with supporting members who may be at risk of losing their Medicaid coverage.

1 (800) 772-6881 x7731 | sales@pfsinsurance.com

Contact a Pinnacle Representative if you have any questions.

1 (800) 772-6881

support@pfsinsurance.com