Medicare is individual health insurance offered to U.S. citizens and other eligible individuals based on age, disability, or qualifying medical condition. The Medicare Basics is more complicated than some would think. Medicare coverage includes Medicare Part A and Part B (Original Medicare) offered by the federal government, and Medicare Advantage (Part C) and Part D prescription drug coverage, which are offered by private insurance companies such as UnitedHealthcare, Aetna, Humana, Cigna, etc. Medicare supplement insurance (Medigap) plans are also offered by private insurance companies and help pay for some out-of-pocket expenses that Medicare Part A and Part B do not pay.

Original Medicare Part A: Hospital coverage

What’s covered:

Hospital stays and inpatient care, including:

- A semi-private room

- Hospital meals

- Skilled nursing services

- Care in special units, like intensive care

- Drugs, medical supplies, and medical equipment used during an inpatient stay.

- Lab tests, X-rays, and medical equipment used as an inpatient.

- Operating room and recovery room services

- Some blood transfusions in a hospital or skilled nursing facility

- Inpatient or outpatient rehabilitation services after a qualified inpatient stay.

- Part-time, skilled care for the homebound

- Hospice care for the terminally ill, including medication to manage symptoms and control pain.

What isn’t covered:

- Personal expenses while hospitalized, like a TV or phone service.

- Most care outside of the United States

- Custodial care (care that helps with daily life activities, like eating and bathing)

- Long-term care

- Days spent in a psychiatric hospital beyond certain set limits.

- Hospital stays beyond certain set limits.

Original Medicare Part B: Medical coverage

What’s covered:

- Doctor visits, including when you are in the hospital.

- Annual wellness visits and preventive services, like flu shots and mammograms

- Clinical laboratory services, like blood and urine tests

- X-rays, MRIs, CT scans, EKGs, and some other diagnostic tests

- Some health programs, like smoking cessation, obesity counseling, and cardiac rehab

- Physical therapy, occupational therapy, and speech-language pathology services

- Diabetes screenings, diabetes education, and certain diabetes supplies

- Mental health care

- Durable medical equipment for use at home, like wheelchairs and walkers

- Ambulatory surgery center services

- Ambulance and emergency room services

- Skilled nursing care and health aide services for the homebound on a part-time or intermittent basis

What isn’t covered:

- Eye exams, eyeglasses, or contact lenses

- Hearing tests or hearing aids

- Dental exams, cleanings, X-rays, or routine dental care

- Acupuncture

- Most prescription drugs

Part B coverage limits: Preventive services and screenings are covered on set schedules, like a yearly flu shot. Other services and supplies must be medically necessary to diagnose or treat a disease or condition.

Private insurance companies, like UnitedHealthcare, Aetna, Humana & others, offer even more coverage options:

- Medicare Advantage (Part C) plans

- Medicare Prescription Drug (Part D) plans

- Medicare Supplement (Medigap) plans

What do Medicare Advantage (Part C) plans cover?

- All the benefits of Medicare Part A*

- All the benefits of Medicare Part B

- Most include prescription drug coverage

- Most have extra benefits you can’t get from Medicare Parts A and B, such as:

- Routine dental care

- Eye exams, eyeglasses, and corrective lenses

- Hearing tests and hearing aids

- Wellness programs and fitness memberships

- Plan options with and without provider networks

- Limitations on annual out-of-pocket costs for Medicare-covered services

- Premiums to fit different budgets.

To run Medicare Advantage comparisons, quote, and enroll clients be sure to check out Pinnacle’s Connect4Medicare Online Enrollment Platform.

What are the features of Medicare Supplement plans?

- Helps cover some out-of-pocket costs that Original Medicare does not pay.

- See any doctor who accepts Medicare patients.

- No referrals needed to see a specialist.

- Coverage that goes with you anywhere you travel in the U.S.

- Guaranteed coverage for life.†

†As long as premiums are paid on time and there has been no material misrepresentation on the application. Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state/area.

What Medicare Supplement plans are available?

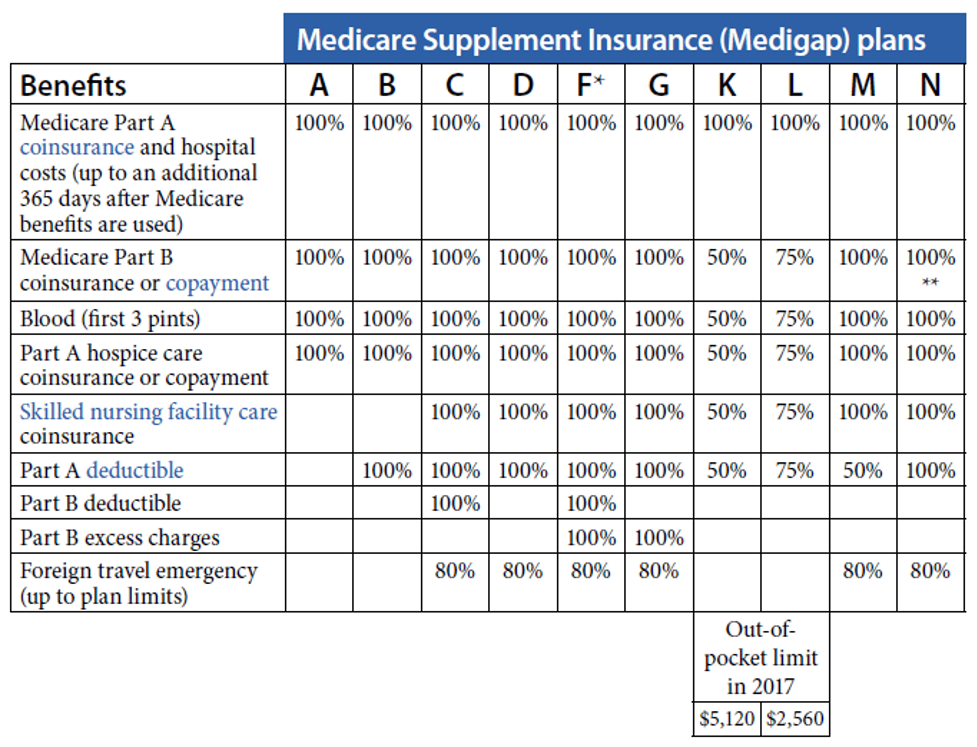

Medicare Supplement plans are often called “Medigap.” There are ten standardized Medicare Supplement plans.

Each plan has a letter assigned to it. Each Medicare supplement plan offers the same basic benefits.

Plans F and G are also offered as high-deductible plans by some insurance companies in some states. If you choose this option, this means you must pay for Medicare-covered costs (coinsurance, copayments, deductibles) up to the yearly deductible amount of $2,370 in 2021 before your plan pays anything.

Note: In Massachusetts, Minnesota, and Wisconsin, there are different standardized plan options available.

Only applicants first eligible for Medicare before 2020 may purchase Plans C, F, and high deductible F.

What does each Medicare Supplement plan cover?

Each of the Medicare Supplement plans offers a varying level of coverage. See what plans match up with the coverage you want by running quotes on our free Medicare quoting tool.

The chart below shows the percentage of the benefit paid by each of the standard Medicare supplement plans. Some plans may not be available. Only applicants first eligible for Medicare before 2020 may purchase Plans C and F.

1 (800) 772-6881 x7731 | sales@pfsinsurance.com

Nick Palo

Assistant Vice President | Health

Contact a Pinnacle Representative if you have any questions.

1 (800) 772-6881

support@pfsinsurance.com

0 Comments