March 15, 2021

A product that can now do more

We have been listening to your feedback and are excited to announce your suggestions were used to enhance EssentialLTC! The changes are geared toward making it easier to sell, and the new features will allow you to offer your clients a product that can do more.

We’ve enhanced its features, options, underwriting classes and the rider selection has been streamlined! These changes will be effective for all new business applications received on or after April 1, 2021 in the following 38 states: AK, AL, AR, CO, GA, IA, ID, IL, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, NC, NE, NH, NM, NV, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, VT, WA, WI, WV, WY.

This information will be distributed in a field communication on March 19, 2021. Please see below for the details on these enhancements.

New Features

- For joint policies, when one insured passes away the premium will now decrease to an amount specified on the illustration and Policy Schedule for each person.

- The Waiver of Premium Rider for Home and Community Care Services is now built into the policy and premium when Comprehensive Coverage is selected.

- The 10-Year Premium Payment Option is now fully guaranteed and will never be subject to a rate increase.

- The underwriting rate classes will be consolidated into single gender-distinct rate class called “Premier”. It is a simplified competitive offering with clearer underwriting expectations.

- The Employer Group rate class will still be available to approved employer groups in the states where it is available.

Streamlined Rider Selection

- Removed: The Step-Rated Compound Inflation Protection Rider

- Still Available: The Compound Inflation Protection Rider with 3% and 5% options

- Removed: The Full Return of Premium Rider

- Still Available: The Limited Return of Premium Rider

- Removed: The Full Return of Premium with Optional Policy Surrender Rider

- Still Available: The Limited Return of Premium with Optional Policy Surrender Rider

- Removed: The 0-Day Elimination Period

- Still Available: The 30, 90 and 180-Day Elimination Periods and the First Day HCCS Benefit Rider

All available riders can be found in our EssentialLTC Product Summary.

Adjustments

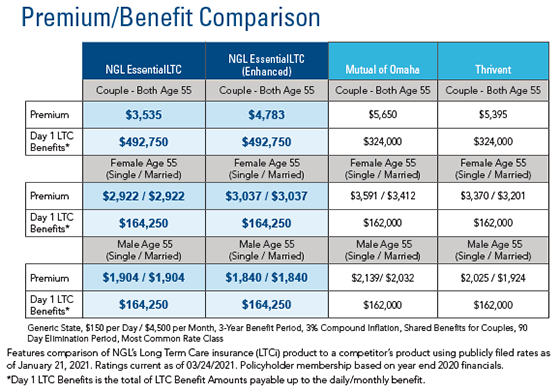

Due to pricing for the new features and historically low interest rates, the premium for the product has changed. EssentialLTC’s rates will remain very competitive compared to the other Long Term Care insurance products on the market. See the chart below or Click here to see how National Guardian Life Insurance Company’s (NGL) EssentialLTC stacks up against some of those products.

Updated Materials

Updated materials will available on the Agent Resource Center beginning April 1, 2021.

New Business

Applications written in the 38 states listed above, must be dated and received in good order by the LTC Administrative Office on or before March 31, 2021 to use the current features and premium structure.

This is applicable to the E-APP, mailed paper applications and uploaded PDF applications. Applications dated or received by the LTC Administrative Office on or after April 1, 2021 must use the updated forms applicable to the client’s resident state. No exceptions will be made.

E-APP

E-APP, the illustration program and the quick quote calculator will reflect the enhancements beginning April 1, 2021.

To use the current version of the product, all parties must complete their signatures in DocuSign and the E-APP must be submitted, in good order prior to April 1, 2021. For BGAs using the E-APP stopover feature, E-APPs must be reviewed and submitted prior to April 1, 2021 to be considered received before the deadline.

Please note, any E-APP where signatures are not complete and/or not submitted prior to April 1, 2021 will need to be rewritten using the updated forms, premium structure and rate class. No exceptions will be made.

At NGL our purpose is to help people face life’s financial challenges with confidence, dignity and grace. Along with our enhanced, easier to sell Long Term Care insurance product, we look forward to continued collaboration with you to protect your clients’ future.

Please contact your dedicated wholesaler with questions.

Larry Moore

Phone: 206.321.7737

Email: ljmoore@nglic.com

Lawrence Vivenzio

Phone: 608.443.4799

Email: lgvivenzio@nglic.com

For more information, contact a Pinnacle Financial Services representative today

1 (800) 772-6881 x6003 | lifesales@pfsinsurance.com

Contact a Pinnacle Representative if you have any questions.

1 (800) 772-6881

support@pfsinsurance.com

0 Comments