Medicare supplemental insurance is administered by private insurance companies to fill the gaps or supplement the costs that original Medicare does not cover. A Medigap policy is different from a Medicare Advantage Plan. Medicare Advantage plans are run by private insurance companies that contract with Medicare to provide Medicare coverage which usually also covers prescription drug benefits.

Clients pay a monthly premium to the insurance carrier for the Medicare Supplement plan in addition to the monthly Part B premium that they pay to Medicare. A beneficiary cannot have a Medigap policy if they already have a Medicare Advantage Plan unless they’re switching back to Original Medicare. Any standardized Medigap policy is guaranteed renewable even if they have health problems. This means the insurance company cannot cancel their Medigap policy as long as they continue to pay the premium.

Why Sell Medigap?

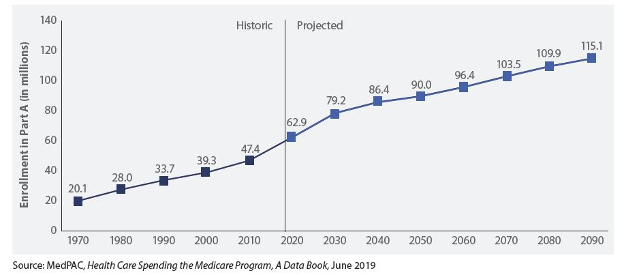

Large Market

- The market size is huge; 10,000 new people become eligible for Medicare every day, 63,964,675 are currently enrolled and eligible for a Medicare supplement, and there will be over 16,000,000 more eligible enrollees in the next 10 years

High-Profit Potential

- Medigap first-year commissions renewals and many times commission advancing. The Cross-selling opportunities are boundless since it pairs very well with other insurance products such as final expense. https://pfsinsurance.com/blog/final-expense-medicare-supplement-dual-applications

- Medigap Commissions – https://pfsinsurance.com/blog/medicare-supplement-commissions

Competitive Rates

- Since coverage is standardized across each plan, clients will receive the same benefits no matter which insurance company they choose. The only differences are in premium amounts which tend to vary by carrier.

Easiest Medicare Product to Start Selling – No Red Tape; No Certification

- Typically there is no certification process required to sell med supps. The exception is United Healthcare.

What do Medigap plans cover?

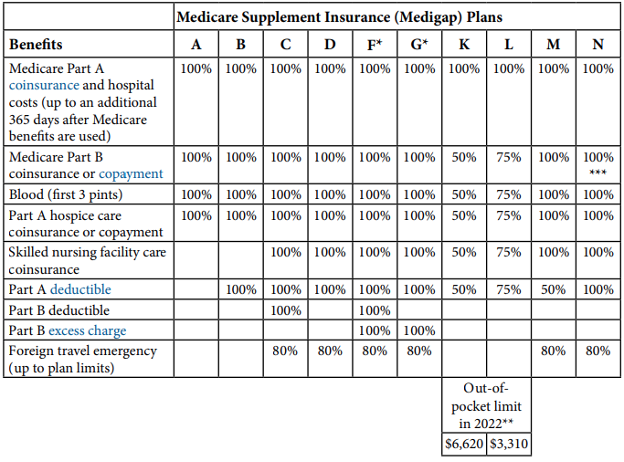

In the illustration below if a percentage appears, that means the Medigap plan covers that percentage of the benefit, and they must pay the rest. If a box is blank, the plan doesn’t cover that benefit

What’s not covered with a Medicare Supplement?

- long-term care

- vision or dental services

- hearing aids

- eyeglasses

- private-duty nursing

Medigap Enrollment

- First, individuals must have Medicare Part A and Part B. A Medigap policy only covers one person. If they and their spouse both want Medigap coverage, they’ll each have to buy separate policies. Many carriers offer discounts for purchases by both spouses.

WHERE CAN I FIND MORE INFORMATION ON PINNACLE FINANCIAL SERVICES?

Pinnacle Financial Services offers direct contracts with dozens of insurance carriers in the senior market. Whether you are selling Final Expense, Annuities, and/or Medicare, our seasoned sales directors can help you get started and guide you through the contracting process. Call Pinnacle today at 800-772-6881 or visit us online at www.pfsinsurance.com to get started!

1 (800) 772-6881 x7731 | sales@pfsinsurance.com

Ben Finch

Director of Agent Onboarding

Contact a Pinnacle Representative if you have any questions.

1 (800) 772-6881

support@pfsinsurance.com

0 Comments