What Does MACRA Mean for Medicare Clients?

What is MACRA?

The Medicare Access and CHIP Reauthorization Act of 2015, (more commonly referred to as MACRA), has many components. One of which is a limit on first dollar coverage in certain Medicare Supplement insurance plans for individuals considered “newly eligible”, including a transition away from using Social Security numbers as identifiers. Additionally, MACRA changes way Medicare pays healthcare professionals. Currently, healthcare professionals are paid based on the number of services they perform. MACRA allows for healthcare professionals to be compensated on quality of care, as opposed to the number of services they perform.

Quality of care versus quantity of care.

Who is Considered “Newly Eligible”?

“Newly eligible” is defined as anyone who is turning 65 on or after January 1, 2020, or anyone who is eligible for Medicare benefits due to age or disability, (as defined by the Centers for Medicare and Medicaid Services- CMS), on or after January 1, 2020.

What does MACRA Require?

As of January 1, 2020, MACRA does the following:

- Prohibits first dollar Part B deductible coverage on Medicare Supplement, so Plans C and F cannot be sold to those “newly eligible” for Medicare.

- Makes Plans D and G the new guaranteed issue plans for those who are “newly eligible” within the guaranteed acceptance rules for Medicare Supplement plans.

- Mandates that a Social Security Number can no longer be used as an identifier.

How are Enrollees in Current Plans C & F Affected by MACRA?

No change. Plans C and F can still be sold after January 1, 2020 BUT, only to Medicare beneficiaries who were age 65 PRIOR to 1/1/2020, or first became eligible for Medicare PRIOR to 1/1/2020, regardless of what plan they had previously. Plans C and F are NOT going away. Current policyholders can continue with their Plan C or Plan F beyond January 1, 2020. Example: A customer who bought Plan F, (or any other plan,) in 2018 can purchase any plan, including C and F, prior to January 1, 2020 or thereafter.

What does MACRA Mean to an Agent?

It will be necessary to make clear distinction between clients eligible for Medicare before and after 1/1/2020. This will decide which product options are available to your client. It will also be important to remember that with Plan F not taking any younger lives into their risk pool, those rates will have a higher chance of increasing significantly in future years. Be sure not to say “Plan F is going away” as it is incorrect and considered a scare tactic. Be sure to check out quotes and change effective dates to see updated rates and availability.

What can Clients Expect to See with MACRA?

Carriers hold the responsibility of education their members on the upcoming changes. This means they should expect to see increasing communication as the year goes on, including mailings, phone calls, guides and webinars. If they have not already, they will start to receive their new Medicare card.

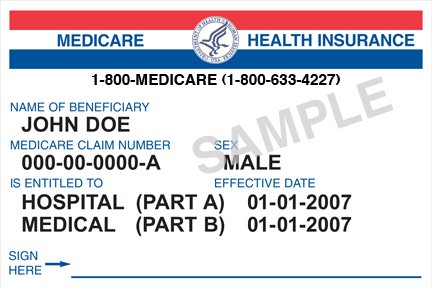

Old Medicare Card

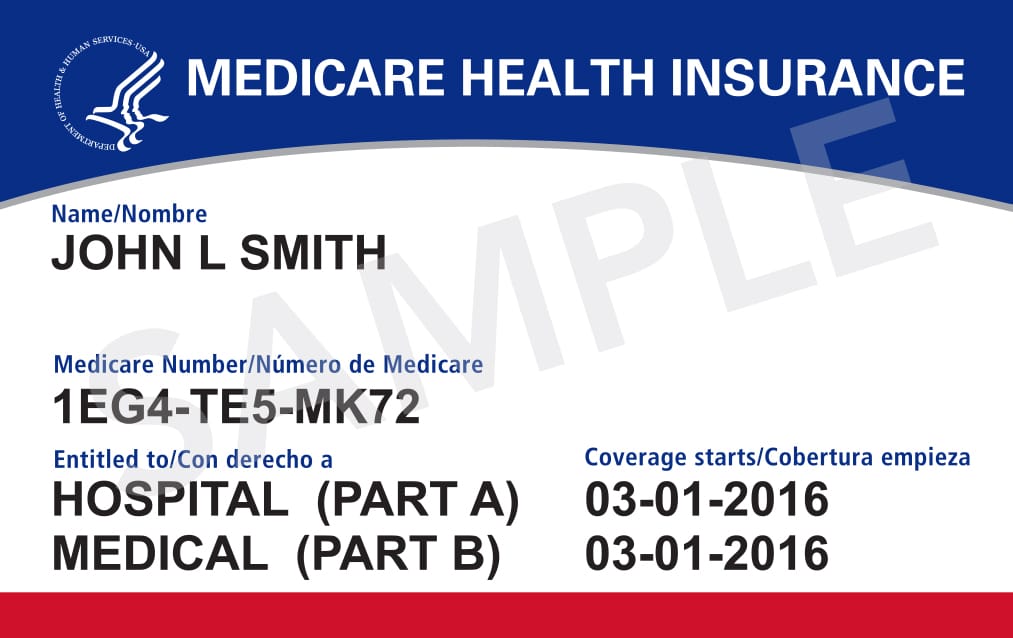

New Medicare Card

MACRA mandates the removal of Social Security Number (SSN), and based Health Insurance Claim Number (HICN), from Medicare Cards to address the risk of beneficiary medical identity theft and fraud.

- New numbers are unique and randomly assigned.

- The new number will be referred to as the Medicare Beneficiary Identifier Number (MBI).

- Beginning April 2018, new cards will be issued and will continue through April 2019.

- Review the new Medicare Card design and press release to learn more.

Next Steps with MACRA

The train is moving and all an agent can do is be informed and look for more information. Pinnacle Financial Services will be continually giving out information and holding webinars to keep you up to date. Be sure to always have the correct information to relay to your clients and inform your decisions.

Contact a Pinnacle Representative if you have any questions.

1 (800) 772-6881

support@pfsinsurance.com